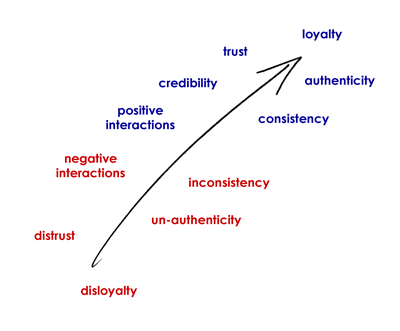

The brand continuum

A brand is the set of perceptions, ideas, words, images and experiences that together help to attract and retain loyal customers. It is often necessary to help differentiate commodity products and intangible services; to give those products and services an identifiable character and help shape the behaviour and personality of the organisations and individuals who deliver them. Sometimes this is the only source of differentiation a customer has on which to make a buying decision.

A brand is founded on perceptions, but should also encompass the aspirations of the organisation and its stakeholders ...and any claims must be reflected by reality.

The continuum shows a range of experiences a stakeholder (this can apply to an employee or an interview candidate as much as it does to a customer) may be subjected to in any of their dealings with your company. Of course those experiences may be interpersonal dealings, hearsay or gossip on the internet or perceptions picked up from written communications. They all count and you need to be aware of them all, because they need to be managed.

The continuum shows a range of experiences a stakeholder (this can apply to an employee or an interview candidate as much as it does to a customer) may be subjected to in any of their dealings with your company. Of course those experiences may be interpersonal dealings, hearsay or gossip on the internet or perceptions picked up from written communications. They all count and you need to be aware of them all, because they need to be managed.